Uniswap

Uniswap让开发者、流动性提供者和交易商能够参与一个开放,并且所有人都能进入的金融市场。

Uniswap

UNI Statistics

Uniswap Price

Trading Volume 24h

Volume / Market Cap

Total Value Locked (TVL)

Uniswap liquidity

Routed through Uniswap

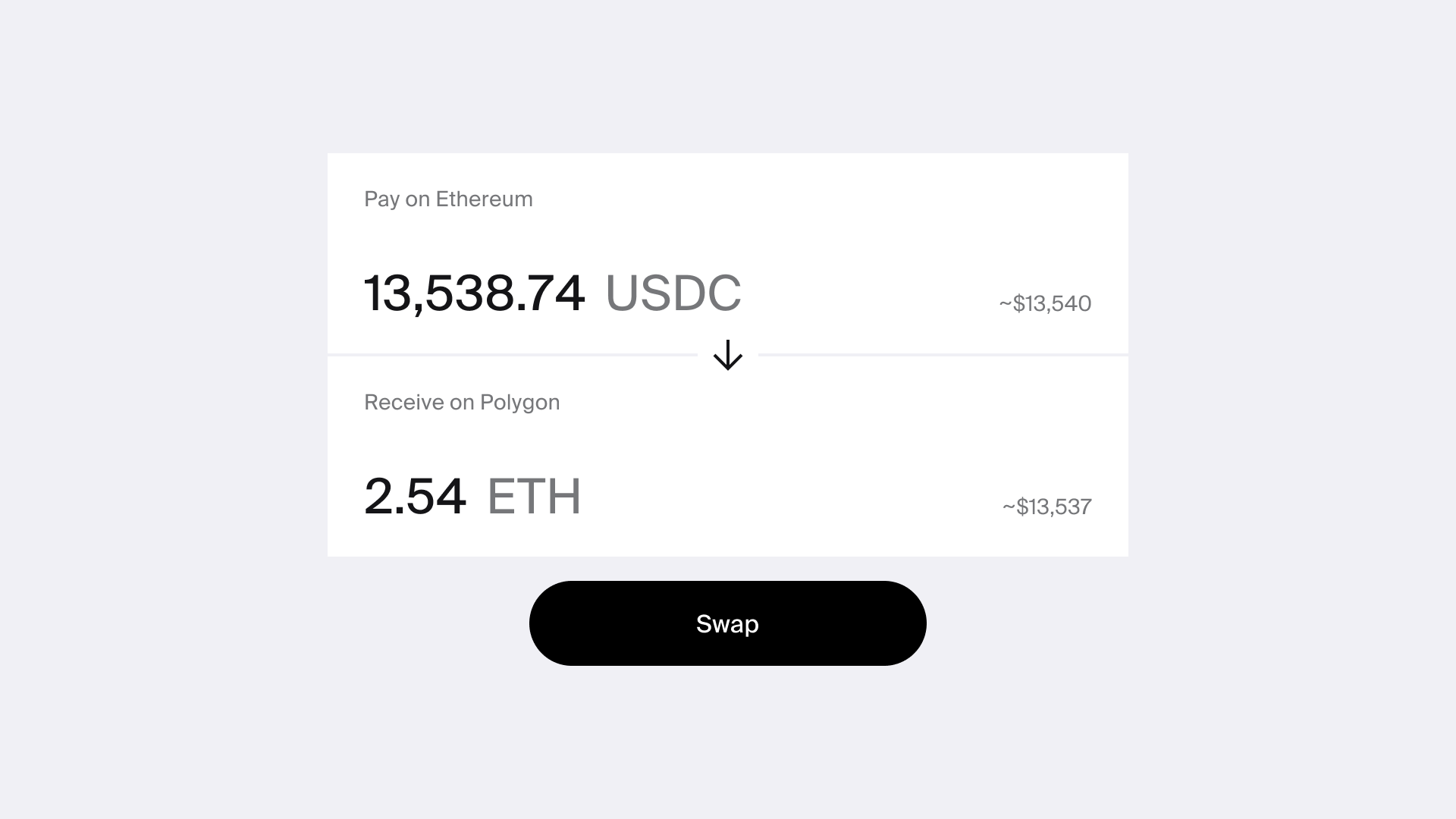

Swap via Uniswap

关于

什么是 Uniswap?

Uniswap是在以太坊区块链上运行的最大和最广泛使用的去中心化交易所(DEX)之一。作为一个去中心化的平台,它允许用户在不需要中介的情况下交易ERC-20代币。Uniswap采用了自动做市商(AMM)模型,而不是依赖传统的订单簿,通过UNI治理令牌为用户提供了一种高效和分去中心化交易、提供流动性和参与平台治理的方式。Uniswap已成为该领域的关键参与者 DeFi 随着2021年Uniswap V3的发布,它将继续创新,在其前身Uniswap V2的基础上进行了几项重大改进。

Uniswap 如何工作

Uniswap的资产管理系统依赖于流动性池,而不是传统的订单簿。被称为流动性提供者(LP)的用户将代币存入流动性池,作为回报,他们收到代表其池份额的LP代币。这些池通过根据供需自动调整代币价格来实现去中心化交易。

Uniswap V2于2020年发布,在原始协议的基础上引入了几项增强功能:

- 直接ERC-20代币闪兑: V2允许用户直接在任意两个ERC-20代币之间进行交易,而无需通过ETH进行交易。

- 闪存闪兑: 闪电闪兑允许用户提取资产,并仅在交易结束时支付,从而允许更先进的DeFi策略。

- 改进的神谕: V2改进了链上价格馈送,以提高可靠性和准确性,使其更能抵抗操纵。

Uniswap V2仍然很受欢迎,而且功能强大,特别是对于不太活跃的流动性池,但V3现在能处理大部分容量,因为它具有更先进的功能。

Related articles

How to read candlestick patterns

Candlestick charts provide detailed visual insights into how an asset’s price changes over time, helping users quickly understand market sentiment.

2025 Oct 10

4 min

1inch’s Sergej Kunz: CEXes will be DeFi front ends

According to 1inch co-founder Sergej Kunz, over the next decade, centralized crypto exchanges are likely to be reduced to frontends for decentralized finance.

2025 Oct 09

1 min

1inch dApp: what’s new?

Following a major rebrand, the 1inch dApp has become even more efficient and user-friendlier.

2025 Oct 08

2 min

FAQ

什么是流动性聚合?

流动性聚合结合来自多个来源的流动性,使用户在代币闪兑过程中可以获得最佳利率和最小的滑点——所有这些都聚合在同一个地方。通过利用整个市场的流动性,1inch简化了闪兑过程,节省了用户的时间和精力。这种高效、去中心化的方法增强了自我托管环境中的闪兑体验。

为什么 DEX 聚合很重要?

DEX聚合是至关重要的,因为它使用户能够通过单一界面在多个去中心化交易所中获得具有竞争力的价格和最佳流动性。由于不同的DEX可能为同一资产提供不同的价格,因此DEX聚合消除了手动比较的需要,确保用户获得最佳价格。此外,闪兑可以根据不同的协议和市场深度进行拆分,从而优化闪兑价格和燃料费使用。有了1inch,用户可以享受无缝的体验,始终如一地提供一流的价格和效率。

Uniswap的用途是什么?

Uniswap是以太坊区块链上最大的去中心化交易所之一,允许用户在没有中介的情况下交易ERC-20代币。它使用自动做市商(AMM)模型,实现高效交易和流动性提供。用户还可以通过UNI令牌参与平台治理。Uniswap推出了Uniswap V3,它提供了集中流动性等高级功能,使交易和流动性提供更加高效和灵活。

Uniswap 和 SushiSwap 有什么区别?

Uniswap和SushiSwap都是使用AMM模型的DEX,允许用户在没有中介的情况下交易代币。Uniswap于2018年推出,以AMM模型的先驱而闻名,并且仍然是最大的DEX之一。SushiSwap是Uniswap的一个分支,创建于2020年,引入了产量农业和赌注等独特功能,以吸引用户并提供额外的金融机会。