Aave

Протокол с открытым исходным кодом, позволяющий пользователям заимствовать криптоактивы и зарабатывать на депозитах.

Aave Token

AAVE Statistics

Aave Price

Trading Volume 24h

Volume / Market Cap

Total Value Locked (TVL)

Aave liquidity

Routed through Aave

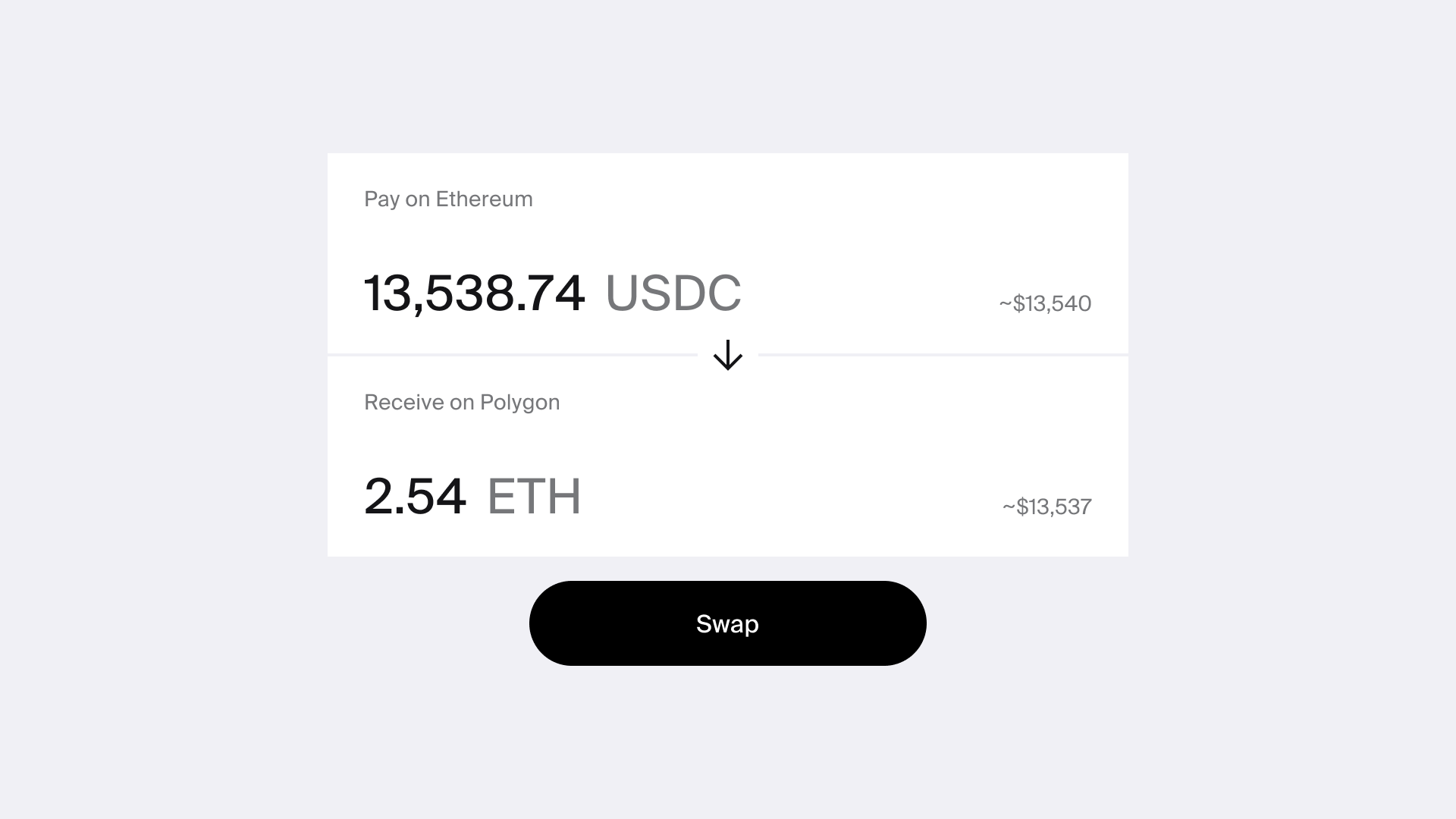

Swap via Aave

О проекте

Что такое Aave?

Aave — это децентрализованный протокол ликвидности, в котором пользователи могут выступать как поставщиками, так и заёмщиками. Поставщики вносят криптоактивы в пулы ликвидности и получают процент за участие. Заёмщики, в свою очередь, предоставляют обеспечение, которое превышает сумму займа — такая сверхобеспеченность защищает интересы поставщиков и стабильность системы. Все средства размещаются в открытых смарт-контрактах, которые управляют процессом заимствования в соответствии с параметрами, определёнными сообществом. Смарт-контракты Aave прошли аудит и верификацию сторонними организациями, что обеспечивает высокий уровень безопасности.

Aave is recognized as one of the largest DeFi protocols, with billions of dollars in weekly transaction volume across the Ethereum blockchain and 12+ other networks. The protocol currently supports more than $19.68 bln in net deposits across 13 networks. On Ethereum alone, the average stablecoin borrow APR in the past year was 9.23%, while the average stablecoin supply APY stood at 6.74%.

How Aave works

Aave's design is based on smart contracts, which autonomously execute lending and borrowing transactions without the need for intermediaries. Borrowers first deposit cryptocurrency as collateral, and the maximum amount they can borrow is determined by the value of the collateral. Aave's system enforces strict rules on loan-to-value (LTV) ratios to protect lenders. Should the value of the collateral fall below a certain threshold, the protocol can automatically trigger a liquidation event, selling off part of the collateral to repay the loan.

One of Aave's defining features is its transparency. Being an open-source protocol, all transactions and code are visible and auditable by anyone. This allows users to maintain control over their funds throughout the process of supplying and borrowing, ensuring a high degree of trust and security.

Related articles

How to read candlestick patterns

Candlestick charts provide detailed visual insights into how an asset’s price changes over time, helping users quickly understand market sentiment.

2025 Oct 10

4 min

1inch’s Sergej Kunz: CEXes will be DeFi front ends

According to 1inch co-founder Sergej Kunz, over the next decade, centralized crypto exchanges are likely to be reduced to frontends for decentralized finance.

2025 Oct 09

1 min

1inch dApp: what’s new?

Following a major rebrand, the 1inch dApp has become even more efficient and user-friendlier.

2025 Oct 08

2 min

FAQ

Что такое агрегация ликвидности?

Агрегация ликвидности объединяет ликвидность из разных источников, чтобы предоставить лучшие курсы и минимальное проскальзывание при обмене токенов. 1inch собирает ликвидность со всего рынка, упрощая процесс обмена и экономя время и усилия пользователей. Такой эффективный подход делает обмен удобнее, сохраняя за пользователями полный контроль над их средствами.

Зачем нужна агрегация DEX?

Агрегация DEX позволяет получать конкурентные курсы и оптимальную ликвидность на разных децентрализованных биржах через единый интерфейс. Разные DEX могут предлагать различные курсы на один и тот же актив, а агрегация избавляет пользователей от необходимости сравнивать их вручную. Кроме того, своп может разделяться между разными протоколами и уровнями ликвидности, оптимизируя как курс обмена, так и расход газа. С 1inch пользователи получают удобный и эффективный обмен токенов по лучшим курсам.

Как используется Aave?

Aave — это один из ведущих децентрализованных протоколов кредитования, который позволяет пользователям вносить активы для получения вознаграждений или брать займы под залог. Работая в сети Ethereum и более чем на 12 других блокчейнах, Aave поддерживает широкий спектр токенов и занимает значительное место в экосистеме DeFi. Aave V2 представил стабильные процентные ставки и эффективное управление ликвидностью, а Aave V3 добавил возможность кроссчейн кредитования и повысил эффективность использования капитала. Инновационные функции Aave делают его универсальным инструментом как для кредиторов, так и для заёмщиков в экосистеме Web3.