Balancer

Balancer é um protocolo baseado no Ethereum, de um Criador de Mercado Automatizado (AMM), o qual permite aos utilizadores negociar e gerir criptoativos.

Balancer

BAL Statistics

Balancer Price

Trading Volume 24h

Volume / Market Cap

Total Value Locked (TVL)

Balancer liquidity

Routed through Balancer

Swap via Balancer

O que é o Balancer?

Balancer is an Ethereum-based automated market maker (AMM) protocol that enables users to trade and manage crypto. Balancer now supports multiple chains, including Polygon, Arbitrum, Avalanche, Optimism and other L2s, offering users broader access across DeFi ecosystems. Balancer pools can be thought of as automatically rebalancing portfolios, wherein anyone can create or join a decentralized index fund and fees go to liquidity providers instead of intermediary fund managers.

Principais características

The most crucial feature of Balancer is its set of algorithms that control and stimulate interactions between traders, liquidity providers and pools according to two objectives: rebalancing pools and finding the best price across multiple platforms.

The Balancer Protocol can be used in these use cases:

- Decentralized exchanges. With no KYC or signups, anonymity and privacy are upheld.

- Liquidity pools that operate as an index fund or an ETF.

- Liquidity bootstrapping. The idea is to create deep liquidity and a more diverse distribution for newly launched projects. This solution provides a project’s team with more control and flexibility in terms of token distribution.

- Boosted pools. In 2024, Balancer introduced enhanced boosted pools, which optimize capital efficiency by using idle liquidity to generate yield, especially for stablecoins. This development aligns with its goal to continually offer advanced liquidity solutions.

Related articles

1inch promptly responds to an unauthorized access incident

1inch swiftly addressed an incident where an attack compromised the 1inch resolver smart contract.

2024 Dec 11

2 min

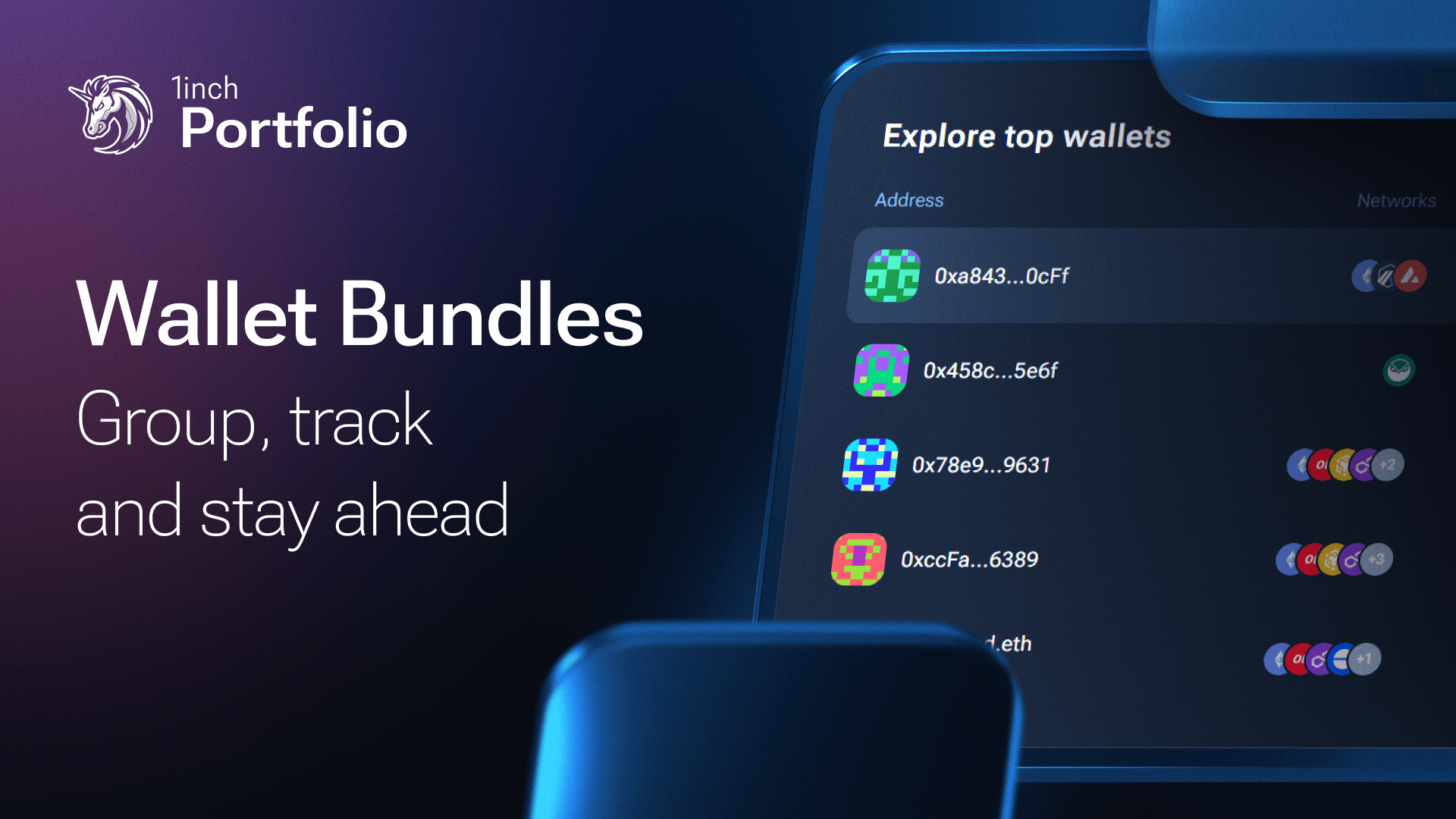

The 1inch Portfolio: simplify your wallet analysis with bundles

The 1inch Portfolio introduces wallet bundles – a smarter way to track asset performance and explore financial opportunities in multiple wallets.

2024 Dec 11

2 min

Keeping сrypto secure: the benefits of watch-only wallets

Watch-only wallets offer a secure method to monitor balances and transactions, with the 1inch Wallet making the feature simple and safe.

2024 Dec 03

3 min

FAQ

What is liquidity aggregation?

Liquidity aggregation combines liquidity from multiple sources to give users access to the best rates and minimal slippage during token swaps – all within a single place. By tapping into liquidity across the entire market, 1inch simplifies the swapping process, saving users time and effort. This efficient, decentralized approach enhances the swapping experience in a self-custodial environment.

Why is DEX aggregation important?

DEX aggregation is crucial because it enables users to access competitive prices and optimal liquidity across multiple decentralized exchanges through a single interface. Since different DEXes may offer varying prices for the same asset, DEX aggregation eliminates the need for manual comparison, ensuring users get the best possible rates. Additionally, swaps can be split across different protocols and market depths, optimizing both swap prices and gas usage. With 1inch, users enjoy a seamless experience that consistently delivers top-tier rates and efficiency.

What is the Balancer DEX?

Balancer is a decentralized exchange and automated market maker (AMM) protocol built on Ethereum. Balancer allows users to swap and manage crypto assets in flexible liquidity pools that function like decentralized index funds, rewarding liquidity providers with fees. It introduced boosted pools to improve efficiency by generating yield on idle liquidity, especially for stablecoins. Balancer’s native token, BAL, is used for governance, allowing holders to vote on protocol upgrades and decisions, enhancing community-driven development within the DeFi ecosystem.